It's raining bulls and bulls

Despite the wealth of available literature and also given the fact that every second person you meet claims to be an expert in this art, financial markets aren't as easy to predict as many would like us to believe.

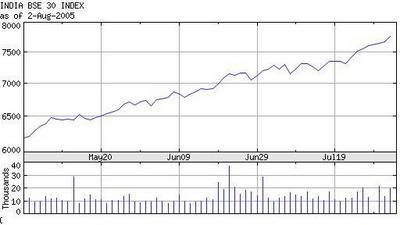

Consider the BSE Sensex for example. Since May, it has rallied around 1500 points. That's an increase of 500 points every month, or 23 points every trading day! Though doomsayers (who are sometimes called pragmatists) have been predicting a deep correction starting July, the markets haven't shown any sign of a dip in exuberance.

Consider the BSE Sensex for example. Since May, it has rallied around 1500 points. That's an increase of 500 points every month, or 23 points every trading day! Though doomsayers (who are sometimes called pragmatists) have been predicting a deep correction starting July, the markets haven't shown any sign of a dip in exuberance.Each day in the past few weeks has seen a clutch of stocks reach their 52-week high - everyday the indices touch all-time highs. Nothing, not even the rains in Mumbai, can stop this bull run, it seems. If some theory can explain all this, I would love to know which.

The higher the indices go, the more cautious one has to become for the impending correction will be as huge. Here too, retail investors are at a terrible disadvantage because they will be the last to catch news of the correction when it comes. The easier route is to book profits by closing all open positions and be at peace. Better safe than sorry be your mantra.

1 Comments:

The universal theory of unpredictability and bull shit randomness.

Post a Comment

<< Home